How can I budget in India ? by Wise Chanakya

What is budgeting?

A budget is an estimation of Income and Expenses over a set time like a day/week/month or year.

You are not the first person who has noticed that your life is starting to get out of control! (Financially)

Have you noticed that you are probably spending a lot more money than you earn from your job or business and the prime reason can be that you have not budgeted properly.

You are probably getting into Debt and cannot afford a comfortable lifestyle. To solve this problem, You need to start budgeting for the sole purpose of plan your finances and keeping your expenses within your budget.

Budgeting is an essential part of your financial planning and in general your life.

In order to live a comfortable life, you need to have a budget!

How budgeting can help you?

There are millions of different ways to manage your finances, but the most important aspect is to develop reasoning and the ability to question yourself before making any purchase and by saying “NO”! To useless purchases which you can easily live without.

It is also important to have a clear picture of your monthly expenses and assuring that you don’t overspend.

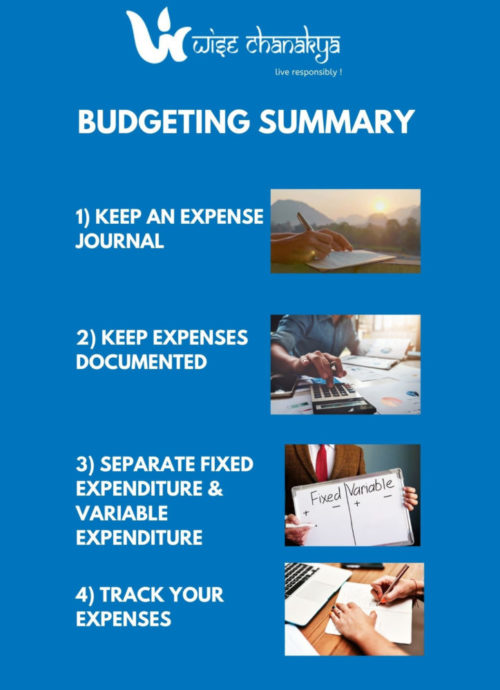

How to start budgeting ?

If you’re not perfect at making lists and keeping a track of your Income & Expenses, Don’t worry because here is a step-by-step guide to start Budgeting your Expenses :-

STEP 1) Maintain an Expense Journal:

To start with Budgeting you need to start maintaining an Expenses Journal which acts as the place where all your expenses are noted and can be used as point of reference.

STEP 2) Keeping your Expenses Documented Properly:

Use the Journal for the purpose of giving clarity on your expenses & not confuse you even further, That’s why proper documentation of your budget is extremely important.

STEP 3) Separate your Fixed Expenditure and Variable Expenditure:

Fixed Expenses(FE)

as the name suggests are those fixed expenses which will occur for sure after a period of time. Like Rent, EMI for Car, Phone, House Loan will be considered as a FE and should be given separate section in your Expense Document.

Variable Expenses (VE)

as the name hints are those expenses which will change over a period of time. Like, Dinning Expenses are variable expenses (If you eat more times in a month your monthly VE will be more & vice-versa)

STEP 4) Tracking your Expenses:

The overall objective to collect proper data was to track your Expenses. You exactly know the amount of money you earn every month (In Most Cases) but only if you follow Step 1,2 & 3 you’ll know the amount of money you are spending.

This allows you to Highlight Expenditure you have, Track the percentage of your each of your expense in relation to your income. Which gives you the power to eliminate wasteful expenditure, set expenditure limit on goods & services which maximizes the Value Extracted from every ₹ Rupee Spent.

We have just scratched the surface of budgeting.

To know more about budgeting you can subscribe to our newsletter. By entering your Email ID and confirming your subscription. We send Mails every Monday on a different topic.

Especially if you are a Parents you can’t miss the opportunity to subscribe to our newsletter & teach your child about crucial financial topics like Budgeting.

Wise Chanakya students as young as 10 Years old who have taken our Basic Course have benefited tremendously from it.

Like our student ANUSHKA who is merely 15 Years old talks about Budgeting & Financial Literacy. Watch her presentation on Facebook.

Link: https://fb.watch/5RUeuN5hbD/